No business owner wants to handle overdue invoices, but unfortunately, this is a common task when selling goods or services. Companies of all sizes deal with accounts receivable issues, and streamlining the process using accounts receivable software for small business owners helps make this part of business more manageable. In fact, 52% of respondents in a 2022 survey agreed that digitizing AR is crucial to reaching their organization’s peak performance.

Table of content

- What is the difference between AP and AR software?

- ezyCollect Review

- Quadient Review

- How can I improve my AR process?

- Frequently Asked Questions

- Do I need to use AR software?

- Can you automate accounts payable?

- What is the difference between AR and AP days?

- Is there a difference between AP and AR automation?

- Does AP or AR send invoices?

- Why separate AP and AR?

- What are the collection strategies for AR?

- What are the four functions of accounts receivable?

- What is a good AR-to-revenue ratio?

- What is the biggest problem with accounts receivable?

- What are the types of accounts receivable?

- What are the GAAP rules for accounts receivable?

- What are the three main issues associated with accounts receivable?

- What is the best KPI for accounts receivable?

- What is the best KPI for accounts payable?

- What are the five strategies for compelling accounts receivable management?

- What are the three main ways to measure accounts receivable performance?

- Is accounts payable harder than accounts receivable?

- Can AR and AP be the same person?

An accounts receivable program helps manage and automate the process while improving your company’s system in creating and managing documents, and tracking invoices, payments, and delinquent accounts.

Let’s take a look at two of the best accounts receivable software options by comparing Quadient vs. ezyCollect:

What is the difference between AP and AR software?

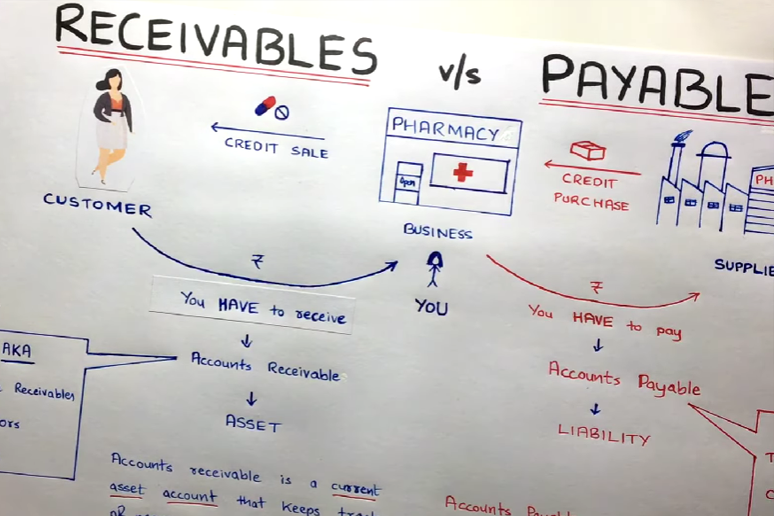

Accounts payable (AP) and accounts receivable (AR) perform different functions, creating a need for two separate software programs. Both AP and AR are a part of an operating business. When these two maintain a healthy balance, a company can grow, and relationships with suppliers and customers remain positive.

AP is a company’s list of short-term liabilities, including paying for items purchased from a supplier and other business expenses. Essentially, AP is the outgoing money, and the software should be capable of tracking suppliers, invoices received, and all outgoing business expense payments.

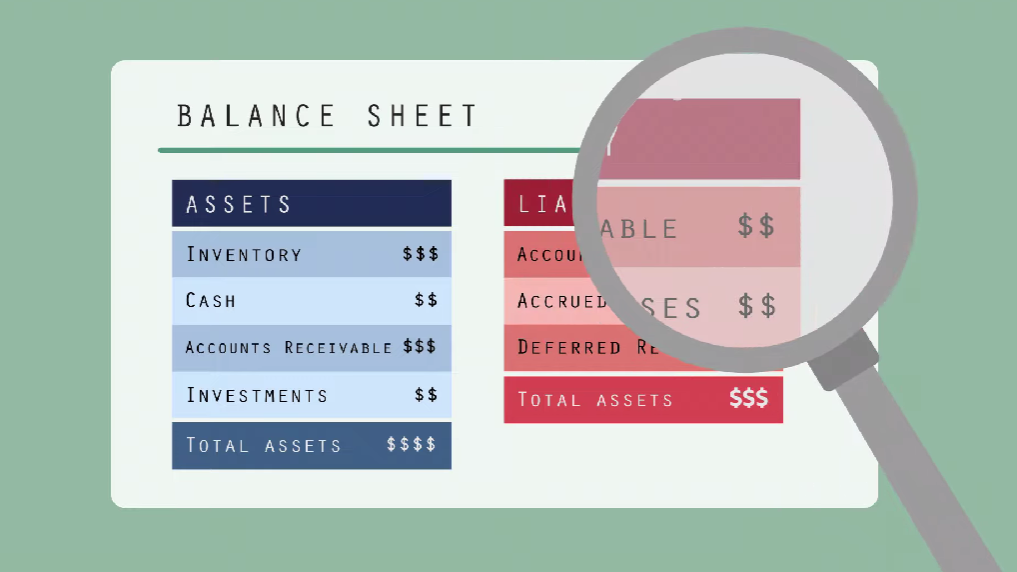

AR is the money a company is owed and expected to receive from customers and business partners. Essentially, this is a list of expected incoming money, and AR software must be capable of recording money owed to the company, invoicing, and collection tracking.

Today, we’re going to look deeper into two leading options for AR software and answer some key questions about AR and AP.

ezyCollect Review

ezyCollect is a software program that helps business owners automate their account receivables. Many business owners who use ezyCollect notice a 43% reduction in overdue invoices within their first six months of using the program. Core features of this AR software include an automated email system, including payment reminders and thank you for your payment emails.

The program also helps centralize communications with customers, featuring call scheduling and client information, as well as detailed information about their account, payment history, and balance due. Additional features of ezyCollect include accounting integration, a user-friendly activity dashboard, and customizable settings, alerts, and notifications.

Positive aspects of the program experienced among those who use it include customizing credit terms based on consumer risk ratings, easy integration with other accounting software programs, and

Some negative aspects of the AR software may include missing select collection features, and some users feel the software is of limited use because it focuses on account receivables.

ezyCollect is the best AR software option for small business owners, mid-sized businesses, large enterprises, and nonprofits.

Quadient Review

Quadient provides businesses with a human-centric communication tool to span the customer’s lifecycle with your company. The software is engineered to organize your AR process while helping create meaningful customer connections.

Quadient offers various features, including a user-friendly activity board, approval process control, offline access, multi-user collaboration, and real-time monitoring and reporting. Additional features include file sharing, templates, and multi-language settings, making it possible to work with others while providing a customizable way to manage your accounts receivables.

Quadient has many benefits, including an intuitive user interface, excellent customer support, and flexible implementation. Though Quadient is a user-friendly AR software, some have reported it is challenging to start without specialized technology training due to the complexity of the software.

Quadient is best for large enterprises, mid-size and small business owners, and public administrators.

How can I improve my AR process?

One of the most demanding challenges business owners face is dealing with overdue and unpaid invoices, which can result in time-consuming and costly actions to collect the debt. Establishing an AR process system can help streamline the collection process while saving you and your team time.

When looking to improve your AR process, take a look at what you are currency doing and consider changing or adding the system to use any (or all) of the following methods:

- Use AR software to help organize your system

- Use AR software to help systemize invoicing and payments

- Develop a collection strategy and be clear on processes and procedures with clients who owe you money

- Automate late payment reminders

- Continue to offer quality customer experiences

- Train and align your team on AR collection processes

- Prioritize collection efforts focusing on the client’s overall balance and not individual invoices

- Offer customers discounts when paying off past-due amounts

- Offer payment installment plans

- If needed, use a collections agency

- Continually review your collection process and adjust where needed to help improve the process

Let’s dive a little further into some other common questions that business owners have about accounts receivable and accounts payable processes.

Frequently Asked Questions

Do I need to use AR software?

Though using accounts payable and receivable software is not required, it does help streamline the AR process, helping reduce the number of unpaid accounts getting overlooked. Additionally, the AR software can help keep your unpaid invoices organized to help increase collection rates and improve your company’s finances.

Can you automate accounts payable?

Automating accounts payable involves a process where human intervention is minimized. AP automation also helps reduce and eliminate error-prone tasks during the process. It is possible to automate the process using AP software to help you connect with your trading partners digitally.

What is the difference between AR and AP days?

Some businesses may dedicate a specific day to conduct all AR or AP business when setting up AR and AP procedures. The difference between the two is that, in one day, you contact customers about unpaid invoices and process all payments received. On AP days, you spend money to ensure all your vendors are paid.

Is there a difference between AP and AR automation?

Both AP and AR can be fully automated to make your job as a business owner easier when paying vendors and collecting money. Automating the processes streamlines the process by sending reminders to customers and automatically paying vendor invoices when they are due. Automation of these two processes helps increase your business’s efficiency.

Does AP or AR send invoices?

AR stands for accounts receivable, and AP stands for accounts paid. AR collects money from clients and sends invoices, while AP receives invoices from others.

Why separate AP and AR?

Separating the AP and AR processes helps reduce the risk of errors and confusion between the different types of accounts. Additionally, suppose you have a different person focusing on the various financial areas. In that case, they are more focused and can quickly identify and resolve discrepancies because they are not distracted by managing both AP and AR processes.

What are the collection strategies for AR?

When setting up your AR system, it is vital to identify your collection strategies and processes. The best way to start setting up your collection strategy is to pull an AR aging report to track and see the payment status of your customers and which ones have past-due accounts. Once you have removed the report, identify and group past owing accounts by timeframe, such as 0-30, 31-60, 61-90, and more than 90 days past due.

Though you want to stay in communication with all your customers about their invoices and try to get them paid before a bill becomes past due, during the collection process, many companies focus on working on the ones that are past due.

Some collection strategies that may help get past-due bills paid may include the following:

- Be proactive in invoicing to ensure on-time payments are made

- Offer an early payment discount

- Move fast to get past-due accounts collected

- If needed, offer a payment plan or partial payment on significantly past-due accounts

- Speak with your bank about cash management tools

- Offer multiple ways to collect payments

What are the four functions of accounts receivable?

Accounts receivable helps a business’s finances and operations by providing four essential functions. The four functions of accounts receivable include the following:

- Identify and set credit terms

- Create detailed invoices

- Send invoices to customers

- Track invoices

What is a good AR-to-revenue ratio?

Accounts receivable to revenue ratio depends significantly upon the type of business. For example, a commoditized company, such as one that sells machinery and electrical equipment, typically has 20 to 30 percent of revenue from AR. Meanwhile, a retailer who sells directly to customers upon payment typically has 1 to 5 percent of revenue from AR.

What is the biggest problem with accounts receivable?

The biggest problem with accounts receivable is the risk of not receiving payment and dealing with late customer payments. Ultimately, this could lead to cash flow challenges and require additional management to minimize the effects of late and non-payment.

What are the types of accounts receivable?

There are a few different types of accounts receivable, and the type used depends significantly on the business’s products and services. The types of receivables include trade accounts, notes receivable, and other accounts receivables.

What are the GAAP rules for accounts receivable?

The GAAP rule for accounts receivable is that the company’s financial statement balance must equal the amount expected to be collected from the customer.

What are the three main issues associated with accounts receivable?

Businesses typically face three main issues when dealing with accounts receivables. These issues include:

- Recognizing you are owed money from a customer

- Putting a value on the invoice and the amount owed

- Working to accelerate the collection process for the invoices

The challenges and effects of these issues can be reduced by implementing an AR software program and collection process.

What is the best KPI for accounts receivable?

KPIs mature the performance of a business’s AR function, and the best KPIs for AR include outstanding day sales, collection effectiveness index, credit risk, and bad debt ratio.

What is the best KPI for accounts payable?

KPI for accounts payable identifies benchmarks of existing operations while highlighting areas of improvement in processes and workflow.

What are the five strategies for compelling accounts receivable management?

When looking to establish a more effective accounts receivable management plan, there are five strategies that you can implement. These five strategies include:

- Establishing transparent payment terms

- Using digital accounting

- Use convenient payment methods

- Evaluate accounts and invoices regularly

- Work as a team

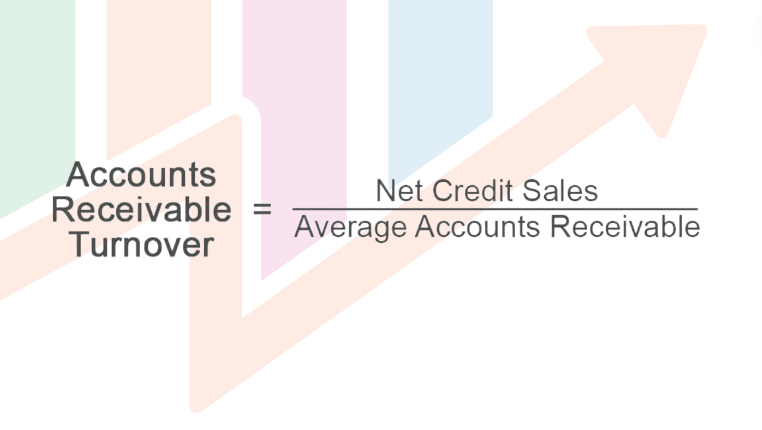

What are the three main ways to measure accounts receivable performance?

There are three ways to measure AR performance: average days delinquent, bad debt ratio, and accounts receivable turnover.

Is accounts payable harder than accounts receivable?

AP is much easier than AR because it involves paying for a company’s debt instead of trying to collect debt from others.

Can AR and AP be the same person?

Smaller businesses can only afford one bookkeeper to do both AR and AP, but having different people working on each process is best. Having more than one person do AR and AP helps streamline the process and allows each person to focus on their area of financial management for the business.

If your business is needing to streamline the accounts receivable process, consider adding AR software to help better organize the process. When determining between Quadient vs ezyCollect, it is important to compare the two based on your needs and which one offers you the best tools to serve your customers. Whichever one you choose, you will find having AR software can improve your customer service and AR collection rates.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.