Recent technological advances have made it easier for businesses and professionals to digitize their accounting and bookkeeping practices. Tax preparation and financial management has never been more seamless, thanks to the advent of cloud-based tax and accounting software. These innovative solutions have revolutionized the way individuals and businesses approach their fiscal responsibilities. By leveraging the power of the cloud, these tools not only simplify the complexities of tax preparation but also offer a cost-effective alternative to hiring expensive professionals. Nevertheless, the abundance of choices available in the current market makes selecting the most suitable solution a daunting task. To help with that, we've narrowed down the best cloud accounting platforms for both individuals and small businesses; but before we get into that, let's cover some of the basics.

Table of content

- What is cloud accounting, and how does it differ from traditional desktop accounting?

- What are the best cloud accounting software options?

- The following 5 options are excellent picks for both individuals and businesses:

- Top 3 Best Cloud Accounting Options for Small Businesses

- Top 3 Free Accounting Software Options

- What is cloud tax software, and how does it work?

- Frequently Asked Questions

What is cloud accounting, and how does it differ from traditional desktop accounting?

Cloud accounting provides an accounting system accessible via the Internet, with ample storage space to house vital personal and business data, including payroll, taxes, sales, and other critical information. Cloud accounting offers users access to their financial data via the software providers website or app allowing both businesses and individuals to stay on top of financial records from any device, and from anywhere.

Cloud accounting differs from traditional desktop accounting because the information is stored and accessed in the cloud, whereas traditional accounting information is stored locally on your computer. This means that if your computer is ever lost or stolen, with traditional desktop accounting software, you lose access to your data. Whereas those who use cloud accounting can access the information from virtually anywhere without sacrificing security and protection of their valuable financial records.

Other significant differences between cloud and traditional accounting may include the following:

- Cost-effectiveness

- Scalability and functionality

- Data security

- Efficient collaboration

- Data storage and reliability

- Technical support

- integration

What are the best cloud accounting software options?

The following 5 options are excellent picks for both individuals and businesses:

Intuit QuickBooks

Intuit QuickBooks provides users with cloud-based accounting software options, in-depth contact records, and transaction forms. Users like the inventory management and time tracking tools to help streamline business processes. Intuit QuickBooks has add-ons available to help support projects, run payroll, and much more.

As one of the best small business accounting cloud programs available, Intuit QuickBooks provides everything needed in one monthly subscription. Prices for QuickBooks start at $30 per month, and rates are based on the add-ons and functions you want.

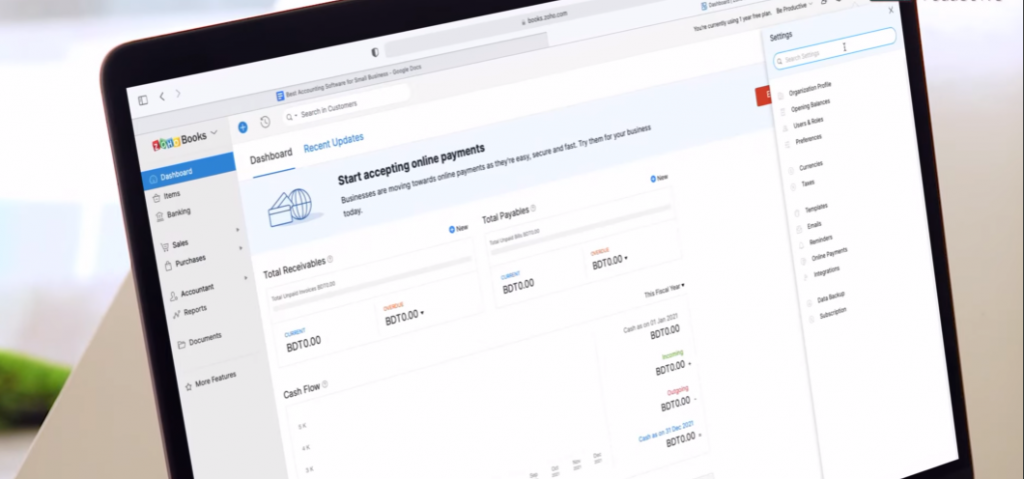

Zoho Books

Zoho Books provides a flexible cloud accounting software platform that tracks sales and purchases, offers customizable reports, and uses a clean user interface and navigation tools. Business owners like using Zoho Books because it is easy for everything from time tracking to payroll and customer and vendor portals to document management. Best for larger small businesses, Zoho Books provides everything a business's accounting needs while keeping the program easy to navigate, even from a mobile device.

On average, Zoho Books costs about $50 per month for the basic version, with other monthly subscriptions available based on the level of access and tools needed.

Wave

Wave is one of the best cloud accounting for small businesses, offering many features for free. This program has a good dashboard, making it easy to navigate while providing excellent invoice and transaction management tools. Wave provides business owners wanting to run various accounting tasks tools for time tracking, customer and vendor portals, inventory tracking, and document management.

Wave is free but lacks some accounting tools that more extensive small businesses may need. For micro-enterprises that do not need the more advanced tools or add-ons, such as payroll, Wave might be the best cloud accounting software for them. Note that some features in Wave, such as receipt scanning and uploading, may be accessible for small monthly fees.

FreshBooks

FreshBooks provides context-sensitive settings, allowing business owners to customize their cloud accounting software. The program offers multiple features, including a friendly user experience, retainers, project and time tracking, inventory tracking, document management, and CRM integration.

What once started as a simple invoicing program, FreshBooks has evolved to provide new tools while enhancing and adding more every year. FreshBooks offers four monthly subscription plans, including a Lite plan starting at $17 monthly. Other plans provide advanced features with varying monthly rates, and FreshBooks offers a Select plan where business owners can customize their plan and pay only for the features they use.

Sage 50

Sage 50 provides users a great dashboard to access in-depth records, reports, and transaction forms. This cloud-based accounting software offers advanced inventory tools and Microsoft 365 integration. Small business owners like the easy-to-navigate platform with tools for time tracking, payroll, document management, etc. Sage 50 is one of the oldest and most comprehensive cloud accounting software programs, featuring many features and customizable options.

Sage 50 offers small business owners three plans, with the Pro Accounting plan starting at $58.92 monthly. The other two plans include additional features and options to add more than one user.

Top 3 Best Cloud Accounting Options for Small Businesses

Oracle NetSuite

Oracle NetSuite is perfect for small businesses looking to build solid customer relationships while managing their finances. This cloud accounting software offers a broad enterprise with multiple planning features, enabling various companies to create customized accounting plans. Small business owners love the simple reporting, customized process, and easy-to-navigate platform Oracle NetSuite offers.

Oracle NetSuite offers various paid features, and monthly costs depend significantly upon the features chosen and the business's financial needs. Prices for NetSuite range from $799 to $1,999 per month, and the number of monthly transactions completed can impact the total monthly costs.

Intuit QuickBooks

Intuit QuickBooks has become the industry standard for small business cloud accounting software. Many business owners use this program to help with bookkeeping, and it can be used for businesses that regularly work with accountants to help with the company's finances. The program features various reporting tools to help with small business operations and for continually growing companies.

Intuit QuickBooks has cloud accounting plans starting at $30 monthly, with higher premiums available for those wanting more comprehensive financial reports. Some advanced features may include multiple users and project tracking tools.

FreshBooks

FreshBooks is the perfect small-business accounting software product because it is designed and well-suited for freelancers and independent contractors. The program is simple to use, including various features such as time tracking and adding billable expenses and hours to clients. The easy-to-use mobile app allows small business owners to reply to clients' questions and sends notifications when invoices have been viewed, paid, or are overdue.

FreshBooks offers plans for small business owners starting at $17 per month, with higher-priced plans containing additional advanced features. The higher-tier plans provide access for multiple users and more detailed accounting features and reports.

Top 3 Free Accounting Software Options

Zoho Books

Zoho Books is an easy-to-use, free cloud accounting software program helping small business owners with invoicing, inventory tracking, and project management. The plan is free and provides business owners with many features to make operations and management more accessible and more efficient. Zoho Books suits smaller to medium-sized businesses seeking an alternative to more extensive, comprehensive, and expensive cloud accounting software options.

ZipBooks

ZipBooks is another popular cloud accounting software providing users with a free version featuring task, time, and project tracking applications. The free ZipBooks version is perfect for relatively new small businesses wanting access to the basic accounting features to help manage their business operations. The online software platform is easy to navigate and allows business owners to create records for contacts, send invoices, track inventory, and track projects and tasks. Paid plans are available for business owners who have grown past the free features and need more comprehensive accounting tools.

Wave Accounting

Wave Accounting is the ideal cloud accounting software for micro-businesses with less than ten employees, providing a free financial management platform that is user-friendly and equipped with many essential features. Wave Accounting allows business owners to manage income expenses, track finances, link bank connections, invoicing, and report. However, like many other free accounting programs, Wave Accounting does have some limitations, especially for growing businesses that eventually need more comprehensive tools and features.

What is cloud tax software, and how does it work?

Most businesses complete their taxes by manually inputting the information or working with a tax accountant. With technological changes, small business owners can now use cloud-based tax software to help streamline their business finances by staying organized and filing their taxes.

Cloud tax software organizes your business records by tax-based categories in one location. Staying updated on all the latest write-offs, claims, income, profit, and other tax filing laws, cloud software programs automatically know what can and cannot be used when filing taxes.

Ultimately, cloud tax software provides business owners with a place to store, connect, and manage all tax-related data from multiple sources. The cloud tax software makes it easy to download documents, generate reports, and ensure the business's financial records add up.

Top 3 Cloud-Based Tax Software

HR Block

H&R Block stands out as a robust contender in the realm of cloud tax preparation software, offering a comprehensive suite of tools that cater to both individuals and businesses. Its user-friendly interface ensures a seamless experience, guiding users through the intricacies of tax filing with ease. The cloud-based platform not only facilitates secure access to tax-related documents anytime, anywhere but also ensures real-time collaboration for businesses managing their financial affairs collaboratively. With features like detailed tax calculators, error-checking mechanisms, and the ability to import financial data seamlessly, H&R Block empowers users to navigate the complex landscape of tax preparation efficiently. Whether you're a sole proprietor managing personal finances or a business entity handling payroll and deductions, H&R Block's cloud tax prep software proves itself as a versatile and reliable ally in the journey towards financial compliance.

Moreover, H&R Block's commitment to continuous updates and compliance with the latest tax regulations provides users with peace of mind, knowing that they are utilizing a cutting-edge solution that evolves with the dynamic nature of tax laws. The platform's ability to adapt to the unique needs of both individuals and businesses sets it apart, making it a top choice in the ever-expanding landscape of cloud tax preparation software. In our exploration of the best tools available, H&R Block earns its place by delivering a user-centric experience and robust functionality that aligns seamlessly with the demands of modern tax preparation.

TurboTax

TurboTax is one of the most commonly thought of cloud-based tax software programs when small business owners start thinking about tax season. This cloud-based tax service offers an outstanding user experience, with in-depth information about tax topics, personalized explanations about tax calculations, and helpful resources. For over 30 years, TurboTax has provided businesses with tax reporting assistance, including record keeping, expense tracking, write-offs, and more. TurboTax offers a DIY for federal returns, including free options; however, most businesses can expect to pay about $59 (or more) for their federal tax return, and state tax returns vary.

TaxSlayer

TaxSlayer is a fast and affordable cloud-based tax accounting program that helps small businesses file their taxes. The program offers a clean interface with intuitive navigation that supports all primary IRS forms and schedules. For more than 50 years, TaxSlayer has helped tax preparers, accountants, and business owners by providing a place to keep all tax records and stay informed about new tax laws. TaxSlayer offers various tax filing plans, including TaxSlayer Premium, starting at $49.95 for federal tax returns, and a plan starting at $59.95 for self-employed federal tax filings.

Xero

Xero offers business owners looking for exceptional online help and new reporting options everything needed with its cloud-based tax accounting software. This accounting platform helps with time tracking, inventory control, payroll, document management, and much more while providing easy access to importing data into tax filing forms, including 1099 support. There are varying levels of Xero, including a free 30-day trial. Monthly prices start as low as $15, and higher-priced plans include more comprehensive features, including tax documents, to help businesses meet their tax filing obligations.

Frequently Asked Questions

Why is cloud accounting better?

Cloud accounting software allows business owners to keep their data on secure online services versus storing it on an office's hard drive. Additionally, using cloud accounting software reduces downtime, which office computers may experience throughout the workday.

Why switch to cloud accounting?

Cloud accounting software eliminates the time between entering records and accessing financial data. Ultimately, business owners can stay on top of their finances in one convenient and efficient location.

Is cloud accounting more expensive?

Most companies find cloud accounting software competitive in pricing compared to traditional methods. Significantly, when business grows, cloud accounting programs have room to grow before upgrading to a more expensive plan.

What are three things accounting software is used for?

The top three things cloud accounting software is used for include invoicing, expense tracking, and tax compliance.

Why should a company use cloud-based accounting?

Cloud-based accounting helps small businesses facilitate real-time collaboration, enabling teams to analyze numbers, make changes, and discuss strategies efficiently. It also provides a platform to securely store financial data accessible by those needing access to financial data and reports.

If your business is looking for a new cloud-based accounting software or wants to switch from traditional accounting, consider learning more about the top cloud accounting platforms we discussed in this article. Take time to research each one and determine the best option available to meet your business accounting needs.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.